Digital colleague Joyce: the insurance check-up from VvAA

VvAA is the voice and support of over 130,000 healthcare providers. VvAA offers healthcare professionals and healthcare organizations advice and services to support primary business operations and cover related risks. This includes offering insurance. To check whether the insurance policies are still appropriate to the situation and future dreams of its customers, VvAA periodically conducts an insurance check-up. This presents a challenge. How does the insurer stay in conversation with all its insurance customers?

To make this possible, VvAA teamed up with Dialog Group to create digital colleague Joyce. Guy Polman, manager Servicedesk at VvAA, talks about the challenges, experiences and successes of this chatbot.

Guy: ‘”We have 130.000 members, many of whom are also customers. Some of these customers we had not spoken to for a long time since 2019. So we wanted to meet with them to check whether their insurance policies were still appropriate for their situation. But having a telephone consultation with all these customers in such a short time frame was operationally and financially not feasible.

So we looked for a sustainable and structural solution that would not only apply to the customer group we hadn’t spoken to in a long time, but would also make sense in the future. After several brainstorms, we arrived at a hybrid customer contact model.

With this hybrid model, we want to periodically reach as many customers as possible so that they make informed choices about their insurance. On the one hand, we have a team of advisors ready to help and counsel customers in terms of content. On the other hand, we deploy chatbot technology and customer case management to automate part of the customer process and support our employees.

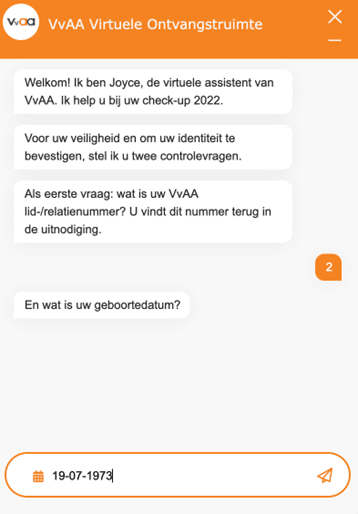

We developed the final solution with the help of Dialog Group, behavioral psychologists, conversation designers, consultants, Customer Care staff and growth hackers. Thanks to this collaboration, process bot Joyce came to life: a digital colleague.

About Joyce, VvAA’s digital colleague

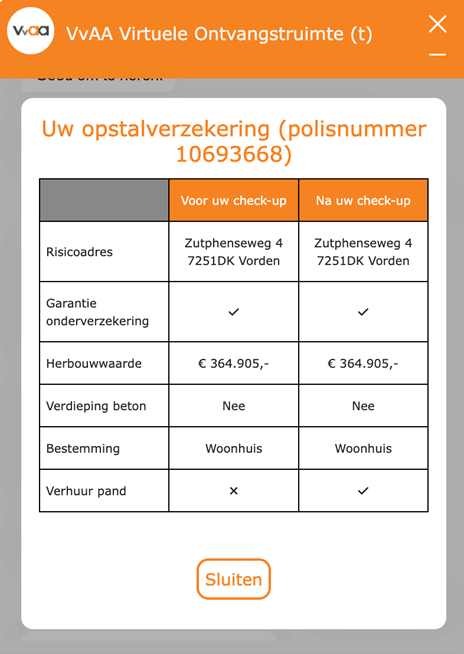

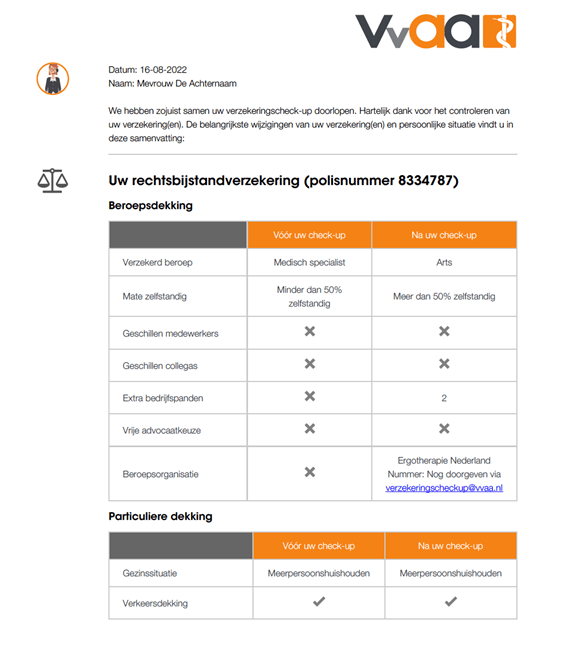

‘Joyce is a process bot that discusses insurance products with customers. Over 40% of the customers invited go through the conversation with Joyce in its entirety. This allows VvAA to provide valuable follow-up care 24/7, without the traditional intervention of an advisor. By continuing to look for smart applications on the customer call processing side, VvAA saves time. And because Joyce actively engages with her customers on behalf of VvAA, the advisors have more time to have substantive conversations with the customers who need it.’

Starting and adjusting

Guy: ‘’We started small in 2020, then gradually learned and further developed Joyce. We first used Joyce for aftercare on our private liability insurance. That is a relatively simple insurance policy so the customer journey was a nice and effective starting point. We invited seniors first, a customer group where we had the assumption that they preferred to talk to an advisor. The opposite turned out to be true. Seniors enjoyed the experience with Joyce and ultimately gave her the highest rating compared to other age groups.’

Customer feedback

‘At the end of every insurance check-up, Joyce asks for feedback. We also do in-depth interviews with clients. That way we can constantly develop Joyce further, make adjustments and it quickly becomes clear where the bottlenecks are in the customer journey. We do this together with Dialog Group, the behavioral psychologists and conversation designers. We are constantly talking to each other. Where does the customer get stuck, where do questions arise, should the call-to-action be adjusted or perhaps the content of the text?

By now we have formed a good understanding of how clients experience Joyce because thousands of insurance check-ups have already been completed. Our clients respond positively to Joyce, which is incredibly valuable to us, but also to the client. When clients complete an insurance check-up with Joyce, they make a conscious choice about their insurance policies and desired coverages and know what suits their situation. This ensures that all of our clients are appropriately insured. That is our goal.’

Advisors are of great importance

‘We want to maintain periodic contact with all of our clients, but for our advisors that is not feasible. Not even if we double the number of advisors. And it is also questionable whether that is necessary. Joyce, the feedback from our clients and the feedback from my colleagues have now answered that question.

Our advisors now have extra time for valuable conversations because of Joyce’s help, and soon they will do so without having to go through all the client’s data before they can actually begin the advisory conversation. The advisor wants to ask questions that matter. How have you arranged your retirement? What are your housing plans for the next few years? What have you arranged in case you become unexpectedly disabled? What are your plans regarding your retirement? That’s the difference between Joyce and an advisor. An advisor can connect the complexities of these questions to give the right advice to the client, while Joyce is good at going through straightforward steps, such as checking certain coverages on a non-life insurance policy.

Currently, we are discovering how to present the things Joyce has picked up from the client during a counseling session. The advisor can pick up where Joyce left off, the client gets good insight into their situation, and so the conversation can be more efficient and effective.

Guy Polman: ‘Because Joyce is so well used by our customers, we can provide large groups of customers with the service they deserve. At the same time, our advisors have enough time to have substantive conversations with customers who need it.’

Getting digital colleague Joyce to communicate about more complex insurance policies

‘Some insurance policies are more complex and we are experimenting with how we can use Joyce for this. One example is the insurance in the event of work disability (AOV). We realize that it is important that the client understands the impact of certain changes on his or her financial situation. But AOV and the specific coverage is a complex matter that is not always immediately clear to customers. That’s why Dialog Group created videos explaining some crucial issues as they go through the insurance together with Joyce. The videos are an experiment to explain in clear language what are important aspects when making choices regarding AOV. And unlike simpler insurance policies, Joyce asks a number of control questions to check whether it is wise for the customer to seek advice.’

How does a digital colleague become successful?

‘When you deploy a chatbot like Joyce, as an organization you have to think carefully about what exactly is needed. Where do you want to put the control? Do you put it with the customer or with the organization? We chose to keep it with ourselves. We do this by having Joyce ask very specific questions, so that all the important questions are answered by the client and we can give good advice. That’s what makes it successful in the end. A chatbot should never be an objective in itself, but a way that can contribute to effective and efficient service. Don’t assume that your bot will be perfect from day one. You must remain curious, make adjustments and always ask yourself: at the end of the process, have I actually been able to help the customer faster and better?’

A digital colleague makes direct customer contact manageable and can be scaled up or down to fit the needs of your organization.

Could you use a digital colleague?

Or schedule an appointment directly for a no-obligation demo.

![]() +31 6 216 82 527

+31 6 216 82 527

[email protected]

LinkedIn

Could you use a digital colleague?

Or schedule an appointment directly for a no-obligation demo.

![]() +31 6 216 82 527

+31 6 216 82 527

[email protected]

LinkedIn

MORE INSPIRATION

Find the right balance between efficiency, accessibility, and human contact in your channel strategy

A successful channel strategy requires a balance between efficiency, accessibility, and human contact. Excessive channel steering can lead to customer frustration and loss, while listening to customer needs and providing diverse channels enhances customer satisfaction and creates a positive brand experience.

The importance of the right Channel Strategy to best serve customers

A well thought out and effective channel strategy can make the difference between satisfied customers and customers going to competitors. Let's look at the importance of a proper channel strategy in serving your customers in the best way possible.

Aspire CEO Kaspar Roos on improving customer experience, managing digital transformation and the future of artificial intelligence

Kaspar is the CEO and founder of Aspire, a consulting firm specializing in Customer Communications Management and Customer Experience Management. Dialog Group and Kaspar have the same mission: to help companies with their digital transformation to improve the customer experience company-wide.